Integrated Approach for Impactful Financial Audit: Insights from SAI Indonesia

Authors: Mokhamad Meydiansyah Ashari and Normas Andi Ahmad

Abstract

This paper examines the integration of performance audit perspectives into financial audits on the Audit Board of the Republic of Indonesia’s (BPK) by using the Financial Audit with Performance Audit Perspective (FAPA) framework. This paper demonstrates how FAPA approach, documented through Long-Form Audit Reports, enhances audit impact by evaluating both financial accuracy and operational effectiveness. Despite challenges in methodological alignment, stakeholder management, timing, and coordination, we present a structured workflow model for effective implementation of the FAPA framework. The paper advocates for further integration of sustainability and foresight elements to promote long-term value creation in public financial management, better meeting evolving stakeholder expectations and supporting Sustainable Development Goals.

I. Introduction – Financial Audit of Public Funds

The scope of audits expanded into the public domain with the signing of the Lima Declaration during the IX International Congress of Supreme Audit Institutions (INCOSAI) in 1977, establishing the foundation for public accountability and transparency (INTOSAI, 1977). While financial audits serve a critical role in the private sector by mitigating information risk for decision makers (Arens et al., 2012), achieving impactful audits in public administration, especially the interplay between audit methodology and good governance of public funds, needs greater attention among SAIs (Páramo, 2023). Some SAIs, such as SAI Latvia, offered an alternative to measure the impact of Latvia’s governments budget by quantifying their audit recommendation from the monetary perspective (SAO Latvia, 2019). Others believe that good governance of public funds could be achieved by auditing consolidated financial statements to analyze financial situation of the public sector as a whole and its financial performance (Turkish COA, 2019). This paper explores the best approaches to enhance financial audit impact in public administration.

II. Audit in BPK

Audit Board of the Republic of Indonesia’s (BPK), as the mandated institution, performs three primary types of audits on government entities: (1) financial audits, (2) performance audits, and (3) special purpose audits. Each type serves a distinct function in ensuring good governance, transparency, and accountability in the public sector.

- Financial audits assess the fairness of financial statements, building public trust and ensuring accurate budget accounting (INTOSAI, 2019a).

- Performance audits evaluate the economy, efficiency, and effectiveness of government programs (INTOSAI, 2019b).

- Special purpose audits, including compliance and investigative audits, ensure adherence to regulations and uncover potential fraud or misuse of public funds (INTOSAI, 2019d).

These comprehensive audit functions are crucial for maintaining accountability and optimizing resource use in government operations. These audits are guided by the State Financial Audit Standards (SPKN) which provide the ethical, professional, and technical foundation for audit practices in Indonesia (BPK, 2017). SPKN is developed in alignment with the International Standards of Supreme Audit Institutions (ISSAI), ensuring that BPK’s audits meet globally accepted standards.

BPK emphasizes the importance of delivering substantial value to stakeholders through its audits, aligning with its vision of being a trusted institution that actively fosters high-quality financial governance to achieve state objectives. Beyond this vision, BPK actively promotes the strategic importance of audits in supporting SDGs through knowledge sharing and multi-stakeholder collaboration (BPK, 2023).

BPK’s audit opinions carry significant implications for Indonesia’s financial credibility in domestic and international contexts. Wijayanti and Suryandari (2020) observed that higher-quality audit opinions correlate with stronger financial performance among local governments. Favorable audit opinions help reduce perceived risk, thereby lowering the yield on government bonds and eventually boost investor confidence (Adinata & Ling, 2022). This relationship between audit quality and capital market performance underscores the strategic value of BPK’s financial audits throughout Indonesia.

Furthermore, BPK audit findings significantly influence government financial performance. According to Indriani and Komala, (2024) these findings play a crucial role in guiding efficient and well-targeted regional expenditure allocations. When audit recommendations are implemented, local governments are better able to prioritize spending based on needs and outcomes, ultimately leading to improved public services and financial sustainability.

III. Integrating Performance-Audit Perspective in Financial Audits

A financial audit provides reasonable assurance over the fairness of an entity’s financial statements by verifying transactions and evaluating internal control processes. By contrast, a performance audit evaluates the economy, efficiency, and effectiveness of resource use against predetermined criteria (INTOSAI, 2019a). Incorporating performance audit procedures helps auditors identify latent risks such as inefficient processes or misaligned objectives that might not surface through purely financial testing (Fano, 2024). By adopting this dual, financial audit and performance audit perspective, organizations can reveal cost savings opportunities and strengthen controls by pinpointing inefficient practices before they impact financial results. As public auditing evolves to meet complex stakeholder demands, Financial Audit with Performance Audit Perspective (FAPA) methodology will be essential to deliver deeper assurance and drive continuous improvement.

Recommendations are tailored to address both corrective actions for financial controls and strategic improvements for enhancing economy, efficiency, and effectiveness in operations. Ultimately, such integration enhances the quality of insights provided to management, enabling stronger governance and strategic decision-making. It also aligns audit work with evolving regulatory and societal expectations that demand sustainability, social impact, and prudent use of funds alongside financial compliance.

Audit reports typically come in two formats: the short-form and the long-form. A short-form report is a concise document that outlines the scope of the audit and the auditor’s opinion on whether the financial statements present a fair and accurate view. By contrast, a long-form report is an expanded audit deliverable that details key risks identified and contextual narrative around internal controls and performance metrics. BPK formally adopted the integrated long-form audit report (LFAR) approach in alignment with INTOSAI-P 12, which calls on SAIs to deliver audits that demonstrate both compliance and value for money by combining financial and performance audit questions into a comprehensive report.

BPK has issued a dedicated LFAR guideline to steer pilot engagements at five regional offices during the first half of 2020. These pilot LFAR reports have delivered richer, multi‐dimensional insights: stakeholders receive not only an audit opinion on financial statements, but also evaluations of program efficiency, effectiveness, and economy. Feedback from regional governments indicated that LFAR findings were more actionable and easier to understand, fostering stronger management commitment to corrective actions and service improvements (Fitrianto, 2023). BPK extends its influence globally by issuing LFARs for international organizations like the International Atomic Energy Agency (IAEA) and the International Maritime Organization (IMO) as their appointed external auditor. This role showcases Indonesia’s credibility in public sector auditing, enhances transparency in these organizations, and strengthens the country’s reputation in international governance and multilateral cooperation.

For example, in the audit of International Maritime Organization, BPK scrutinized the implementation of the Organization’s technical cooperation in three critical areas: resources management, risk management, and result-based management. BPK assessed how effectively the IMO allocated and utilized its financial and human resources to support its technical cooperation objectives, evaluated the adequacy of its risk identification and mitigation strategies to ensure program resilience and sustainability, and reviewed the extent to which the organization applied a results-based management approach to measure outcomes, track progress, and ensure accountability.

IV. Results and Analysis

Implementing FAPA enhances comprehensiveness by adding performance metrics to traditional financial assurance. However, performance audit methodologies diverge substantially from financial audit practices, necessitating that the performance audit team to develop and apply unique criteria, metrics, and data-analysis techniques, which need to be reconciled to produce coherent, integrated findings. ISSAI 3000 underscores the need for clarity in standard selection when audits overlap, advising that “all relevant standards should be observed” (INTOSAI, 2019b). It also notes that audit statements may need adjustment to reflect both financial and performance criteria—an aspect currently not fully integrated into BPK’s FAPA process, where financial audit and performance audit teams operate with separate agendas.

When auditing an organization, aligning the financial and performance audit teams mostly means agreeing on sampling and evidence rules, something that can be handled with cross-training and joint planning. However, when the performance audit focuses on complex initiatives such as SDG implementation, aligning the objectives, data sources, and stakeholders’ expectation requires extensive consultation and meticulous planning processes. These audits engage a wide array of stakeholders, including government ministries, development partners, civil society, and private sector actors as well as involve multiple layers of targets and indicators, significantly complicating standard selection and application compared to internal organizational audits (IDI, 2024).

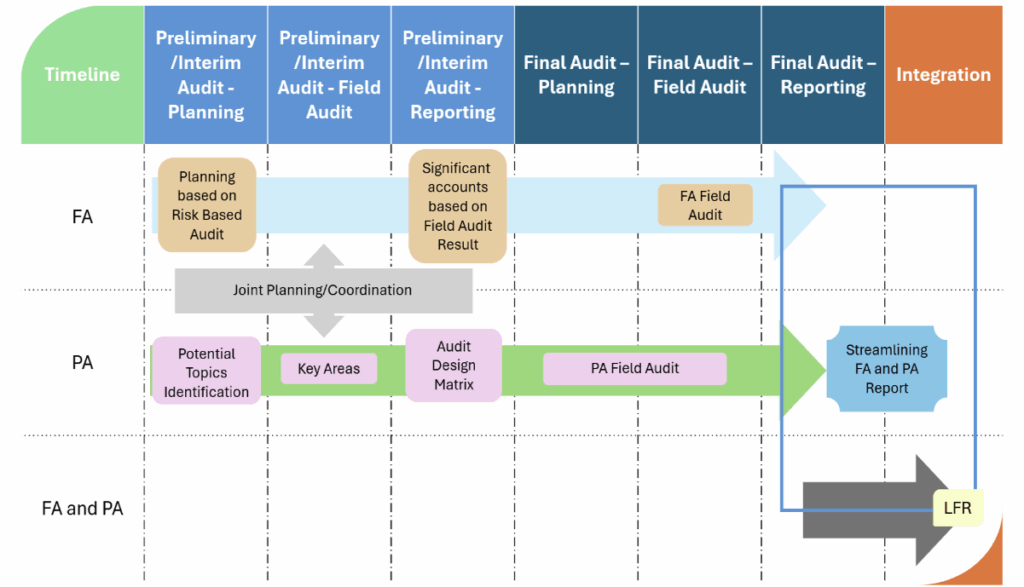

Another challenge stems from the differing timeframes of financial and performance audits. Financial audits typically follow an annual cycle, with auditors conducting a full review of an entity’s financial statements once per fiscal year. Performance audits, by contrast, are designed to assess programs and activities over a period often exceeding two years, requiring extensive planning and periodic risk reassessments. This disparity in time scope creates significant coordination challenges when integrating audit teams. To mitigate the challenges above and optimize the output from both perspectives, we proposed the integrated FAPA workflow, shown in the figure below.

Figure 1: Proposed Workflow of FAPA

V. Outlook and Conclusion

The integration of performance audit perspectives into financial audits through the FAPA framework represents a significant advancement in public sector assurance practices. By combining traditional financial verification with assessments of the economy, efficiency, and effectiveness, SAIs can deliver more comprehensive and impactful oversight. The long-form audit report serves as an effective vehicle for communicating these multidimensional insights to stakeholders.

Implementing this integrated approach presents challenges—methodological differences, stakeholder complexity, and misaligned timelines—but these can be overcome through the structured workflow model proposed. The dual-team approach, with clear roles, joint planning, and shared platforms, enables auditors to fulfill both financial and performance objectives within a single engagement.

As audit practices continue to evolve, SAIs should expand beyond the FAPA framework to incorporate emerging priorities. Embedding aspects such as sustainability and foresight into audit criteria will become increasingly critical. By embracing forward-looking dimensions in their integrated audit approach, SAIs can position themselves as strategic partners in promoting not only fiscal accountability but also long-term sustainable value creation. This evolution will ensure that public sector auditing remains relevant and impactful in addressing the complex challenges facing governments in the coming decades.

About the Authors

Mokhamad Meydiansyah Ashari

Mr. Ashari is a senior auditor with master’s degree in accounting from The University of Nottingham. He is currently the external auditor who specialize in financial audit with extensive experience in auditing International Organization such as International Atomic Energy Agency (IAEA), International Maritime Organization (IMO), and Coral Triangle Initiative on Coral Reefs Fisheries, and Food Security (CTI-CFF).

Mr. Normas Andi Ahmad

Mr. Ahmad is a senior auditor with a master’s degree in Environment and Sustainable Development from the University of Glasgow. He has extensive experience leading audit teams in the areas of energy, environmental, and natural resource management, as well as audits related to the Sustainable Development Goals (SDGs). He is also actively involved in the activities of the INTOSAI Working Group on Environmental Auditing (WGEA).

Bibliography

- Adinata, W., & Ling, M. (2022). Analisis Pengaruh Opini Audit BPK Terhadap Tingkat Imbal Hasil (Yield) Surat Berharga Negara. Indonesian Treasury Review, 7, 329–346. www.kemenkeu.go.id

- Arens, A. A., Elder, R. J., & Beasley, M. S. (2012). Auditing and assurance services: an integrated approach (14th ed.). Prentice Hall.

- BPK. (2017). Standar Pemeriksaan Keuangan Negara (Peraturan Badan Pemeriksa Keuangan Nomor 1 Tahun 2017). Art. Peraturan Badan Pemeriksa Keuangan Nomor 1 Tahun 2017. https://www.bpk.go.id/assets/files/storage/2017/01/file_storage_1484641204.pdf

- BPK. (2023, June 5). BPK Promotes the Leverage of Performance Audit Impact, Especially in the Green Economy. Https://Www.Bpk.Go.Id/Assets/Files/Attachments/Attach_post_1686620615.Pdf. https://www.bpk.go.id/news/bpk-promotes-the-leverage-of-performance-audit-impact-especially-in-the-green-economy

- Fano, K. (2024, December 18). How Performance Audits Can Drive Efficiency and Development Impact | Asian Development Blog. https://blogs.adb.org/blog/how-performance-audits-can-drive-efficiency-and-development-impact

- Fitrianto, R. (2023). Implementasi Long Form Audit Report pada BPK Perwakilan Provinsi Lampung. Universitas Gajah Mada.

- IDI INTOSAI. (2024). IDI’s SDGs Audit Model ISAM 2024.

- Indriani, R., & Komala, L. (2024). The Effect of Regional Expenditure, Balancing Funds and BPK Audit Findings on Regional Government Financial Performance. Taxation and Public Finance, 2(1), 44–55. https://doi.org/10.58777/tpf.v2i1.297

- INTOSAI. (1977). The Lima Declaration. https://www.issai.org/wp-content/uploads/2019/08/INTOSAI-P-1-The-Lima-Declaration.pdf. https://www.issai.org/pronouncements/intosai-p-1-the-lima-declaration/

- INTOSAI. (2019a). ISSAI 200 – Financial Audit Principles. INTOSAI.

- INTOSAI. (2019b). ISSAI 300 – Performance Audit Principles. INTOSAI.

- INTOSAI. (2019c). ISSAI 3000 Performance Audit Standard. INTOSAI, 1–33.

- INTOSAI. (2019d). ISSAI 400 – Compliance Audit Principles. INTOSAI.

- Páramo, R. C. D. (2023). Making a Great Impact on Government and Citizens: Audit Methodologies and the Working Group on Value and Benefits of SAIs (WGVBS). International Journal of Government Auditing, 50(3).

- SAO Latvia. (2019). Measuring Impact and Relevance of Work Performed by the State Audit Office of Latvia. EUROSAI Magazine, 25, 100–102.

- Turkish COA. (2019). The Bigger the Picture, The Greater the Value of Financial Accountability: The Turkish Court of Accounts’ Experience in the Audit of The Consolidated Financial Statements of Government. EUROSAI Magazine, 25, 103–106. https://www.sayistay.gov.tr/en/Upload/

- Wijayanti, Y., & Suryandari, D. (2020). The Effect of Regional Characteristics, Leverage, Government Complexity, BPK Audit Findings and Opinions on Local Government Financial Performance. Accounting Analysis Journal, 9(1), 30–37. https://doi.org/10.15294/aaj.v9i1.22483